(Bloomberg) —

Investors have committed $650 million to two so-called natural capital funds backed by HSBC Asset Management.

The funds are managed by Climate Asset Management, which is jointly owned by HSBC Holding Plc’s investment unit and climate change investment and advisory firm Pollination. One of the funds will invest in agriculture, forestry and environmental assets, while the nature-based carbon strategy will seek to create a pipeline of high-quality carbon credits for companies trying to reach net-zero emissions, according to a statement posted Tuesday.

Natural capital is emerging as a fast-growing asset class with firms including the investing arm of BNP Paribas SA, Swiss money manager Lombard Odier Group and the UK’s Aviva Plc starting funds and other products aimed at generating profits from investors’ increasing appetite for exposure to nature. Just as investors have found opportunities to make money from the net-zero transition, some are now looking at how to benefit from initiatives aimed at halting nature decline and restoring biodiversity.

HSBC Asset Management and Pollination announced their joint venture in 2020 with the intention of creating the world’s largest natural capital manager and making natural capital a “mainstream” asset class. The partners also said they intended to raise up to $1 billion for its natural capital fund and $2 billion for the carbon credit fund from investors, including sovereign wealth funds and pension funds.

HSBC is a cornerstone investor in both funds, and insurers from Europe and Asia are among the initial investors, said Christof Kutscher, Climate Asset Management’s chief executive officer, in an interview. A second and third close for the funds are expected next year, he said.

“Fundraising for a new strategy, a new company in a new asset class takes a while,” Kutscher said. “The competition isn’t sleeping. We know people see natural capital as an asset class.”

Both funds carry the EU’s highest ESG designation as they are classified as Article 9 under Europe’s Sustainable Finance Disclosure Regulation, Kutscher said.

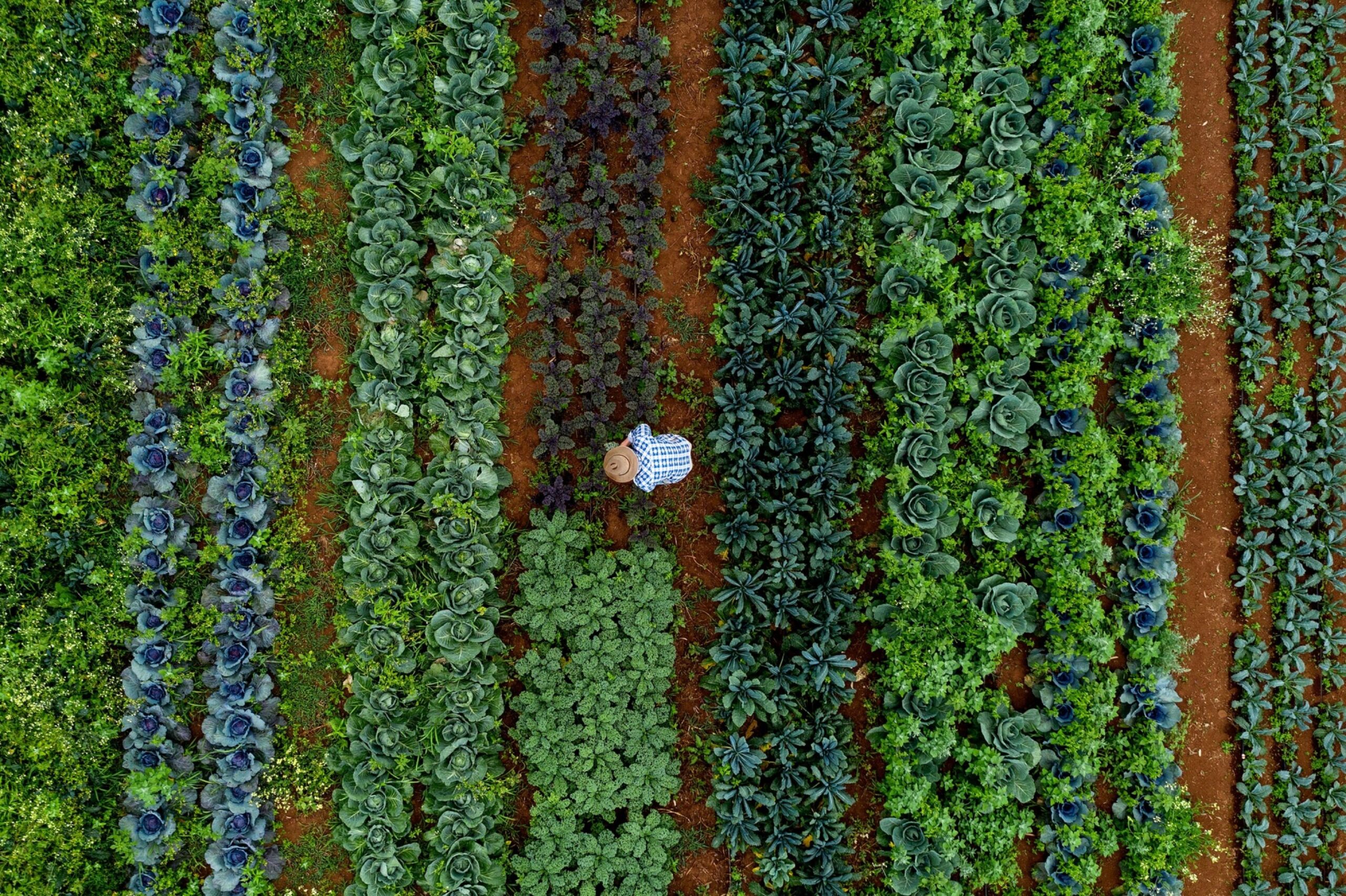

The natural-capital strategy will focus on investing in depleted or overexploited land in the Organization for Economic Co-operation and Development countries to deliver returns from improving land-use practices, boosting crop yields and protecting biodiversity, Kutscher said. An initial land development project in Extremadura, Spain, will see the transformation of 400 hectares of traditionally flood-irrigated farmland to “regenerative high-value almond production, with specific areas allocated towards enhanced biodiversity,” according to the statement.

Investors in the carbon strategy will receive carbon offsets to use for carbon accounting, instead of a regular financial return, said Martin Berg, chief investment officer of the strategy. Last year Climate Asset Management announced a $150 million partnership with the Global EverGreening Alliance nonprofit, where it would provide financing to restore more than two million hectares of land and support farms in six African countries by generating carbon credits.

Growing investor interest in natural capital may be buoyed by an increasing focus on the topic from policymakers. A United Nations-run conference on protecting biodiversity is taking place this month in Montreal with representatives from 191 countries seeking to negotiate an ecological deal that may have similar significance as the 2015 Paris Agreement on climate change.

“It’s good to show for COP15 that there are real investors out there who focus on natural capital investments,” Berg said.

To contact the author of this story:

Alastair Marsh in London at amarsh25@bloomberg.net

© 2023 Bloomberg L.P.