(Bloomberg) —

BlackRock Inc. will invest $550 million of client money into Occidental Petroleum Corp.’s Stratos project, which will be the world’s largest plant capturing carbon dioxide directly from the air.

BlackRock’s diversified infrastructure business signed an agreement through one of its funds to form a joint venture with Occidental’s 1PointFive subsidiary that will own Stratos, the companies said Tuesday. Occidental shares climbed as much as 1.7% in after-hours trading.

The BlackRock investment represents about 40% of the project’s total $1.3 billion cost, making it one of the largest investments in direct air capture to date. It also means Occidental’s share of the cost is reduced, freeing up capital for its Permian Basin oil and gas operations.

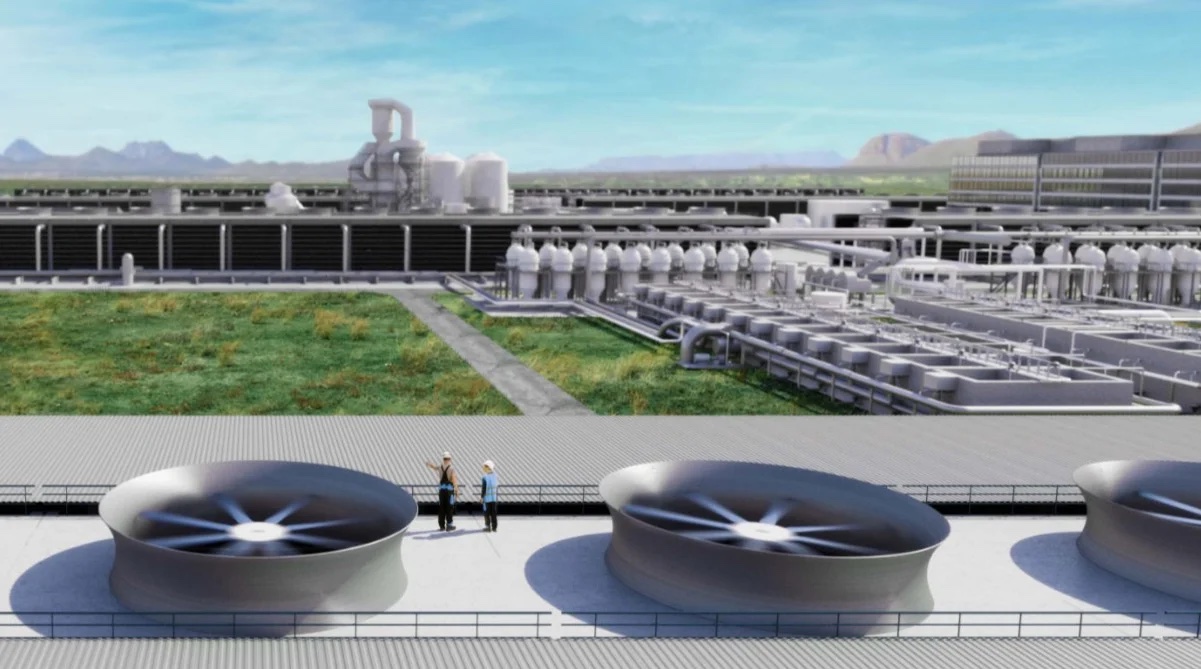

Stratos is designed to pull 500,000 tons of carbon dioxide out of the air each year — roughly equivalent to the emissions from 1 million barrels of oil — and then bury the planet-warming gas underground, generating carbon removal credits. Companies including Amazon.com Inc. and Airbus SE have already agreed to buy some of these credits to offset their emissions. The project, which is expected to start up in 2025, is currently under construction in Ector County in West Texas and is 30% complete.

Read more: Occidental Sees More Carbon Uses from World’s Biggest Plant

Occidental said it’s receiving strong demand for the credits, which are seen as higher quality than other types of carbon offsets that rely on complicated and dubious emissions accounting. The company is targeting revenue of $580 to $810 a ton from Stratos, with about of that $180 coming from tax breaks from the Inflation Reduction Act. That compares with costs of $400 to $500 a ton, which Occidental expects to fall as more plants are built.

Demand for carbon-removal credits may increase in the coming years as airline operators seek ways of offsetting their emissions, Occidental said. They are “expected to cost less” than reducing emissions by using sustainable aviation fuel, the company said.

“This joint venture demonstrates that direct air capture is becoming an investable technology, and BlackRock’s commitment in Stratos underscores its importance and potential for the world,” Chief Executive Officer Vicki Hollub said in the statement.

The project isn’t without risk. Stratos will have more than 100 times the capacity of the Orca plant run by Climeworks AG in Iceland, the only other industrial-scale direct air capture plant in the world. And some of the CO2 captured by Stratos may be injected into old oil reservoirs to produce more crude, a proposal that has drawn the ire of environmentalists.

About 90% of the captured CO2 will be available for sales of carbon-removal credits, Occidental said Tuesday.

For BlackRock, the joint venture is also a major investment in Texas, where the money manager has faced about two years of backlash from Republican politicians for supporting ESG and sustainable investment funds. Lone Star state lawmakers have alleged the company boycotts the oil and gas industry and have moved to restrict investments by state and local agencies in BlackRock shares and the company’s funds.

The company has sought to rebut the allegations by touting its investment in the energy industry, and last year BlackRock said its clients have invested more than $300 billion in Texas. The carbon capture project will employ more than 1,000 people during construction and as many as 75 once operational, the companies said.

“I’m a big believer that the multibillion-dollar success stories of the next few decades are going to be written in the energy sector,” BlackRock CEO Larry Fink said in a statement. “They’re going to be companies that invest in technologies like direct air capture.”

(Updates with shares in second paragraph, details throughout.)

© 2023 Bloomberg L.P.