(Bloomberg) —

Xavier Chollet runs a clean-energy fund that’s beating the market with bets that might not be immediately associated with green investing: Semiconductors.

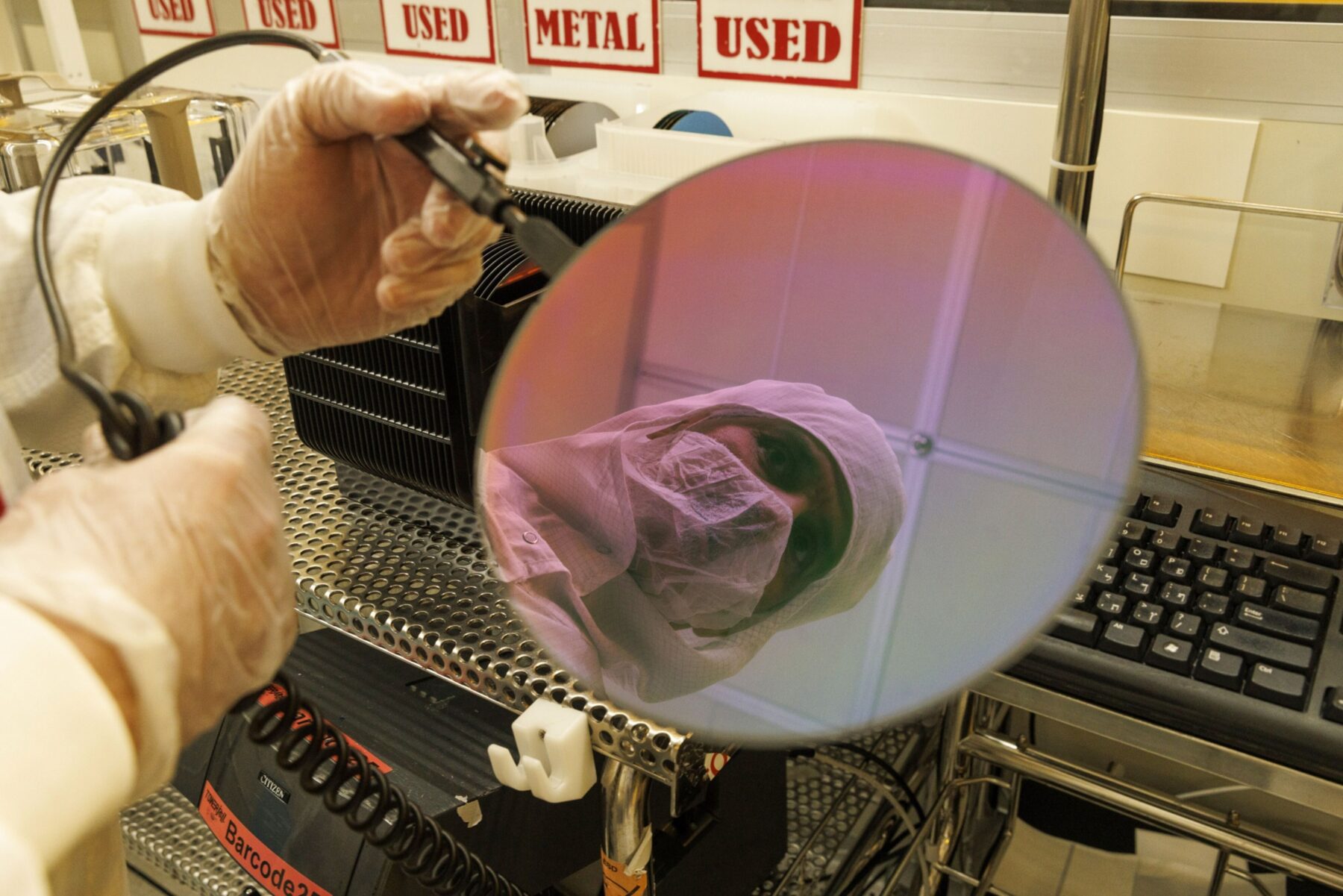

The $5.3 billion Pictet Clean Energy Transition fund, which holds the likes of Tesla Inc. and Vestas Wind Systems A/S, has almost a third of its assets in chip companies, focused on those that make devices that minimize energy loss when electricity is used. Chollet’s top holdings include ON Semiconductor Corp., Marvell Technology Inc. and NXP Semiconductors NV.

Even after this year’s surge in stock prices caused the sector’s valuation to almost double, Chollet says the momentum is only beginning, thanks to the arrival of artificial intelligence tools that will increase demand for chips.

“Sure, valuations have expanded but in the case of many of these names we are still below the valuations of the S&P 500,” the Geneva-based fund manager said in an interview. “Even more so now with arrival of Chat GPT, providing more growth and profitability. Even at these levels, clearly valuations still make sense, of course.”

Pictet Clean Energy, which Chollet manages with Manuel Losa and Guillaume Martin-Achard, has returned 21% this year, beating 93% of peers and outpacing the S&P 500’s 19% return.

The types of chip companies he owns are appealing because they are less affected by economic cycles and there’s a high barrier to new entrants, Chollet said. The fund also owns suppliers to the chip industry, such as design-software company Synopsys Inc. and equipment makers Applied Materials Inc. and ASML Holding NV.

“We have been very bullish over the past few years over this group,” he said. “Going forward, the two major growth drivers which will lead to an increase in the growth of the industry are electric cars and AI.” The fund has trimmed its stake in ON Semiconductor and Marvell this year but they’re still among its largest holdings.

Most of the investments are in US stocks due to the amount of choice compared to Europe, he said. The fund’s 25% renewables exposure is mostly Europe-based, however, and includes pure solar or wind companies as well as utilities such as Germany’s RWE AG and Nextera Energy Inc. of the US. Solar-equipment maker Enphase Energy Inc. was the biggest positive contributor to the fund performance last year.

Tesla, a long-term position in the fund, is the only automotive pure-play stock in the portfolio. He added to the position at the end of last year when the stock sold off, Chollet said.

Chollet expects a better economic backdrop for the market, saying that inflation is cooling off and peak interest rates are near. “The market is expecting rates to come down next year, which from a valuation point of view would be tailwind for us,” he said.

© 2023 Bloomberg L.P.