(Bloomberg) —

A wave of socially conscious debt has emerged from the developing world, flooding global markets with investments that claim to make the world a better place.

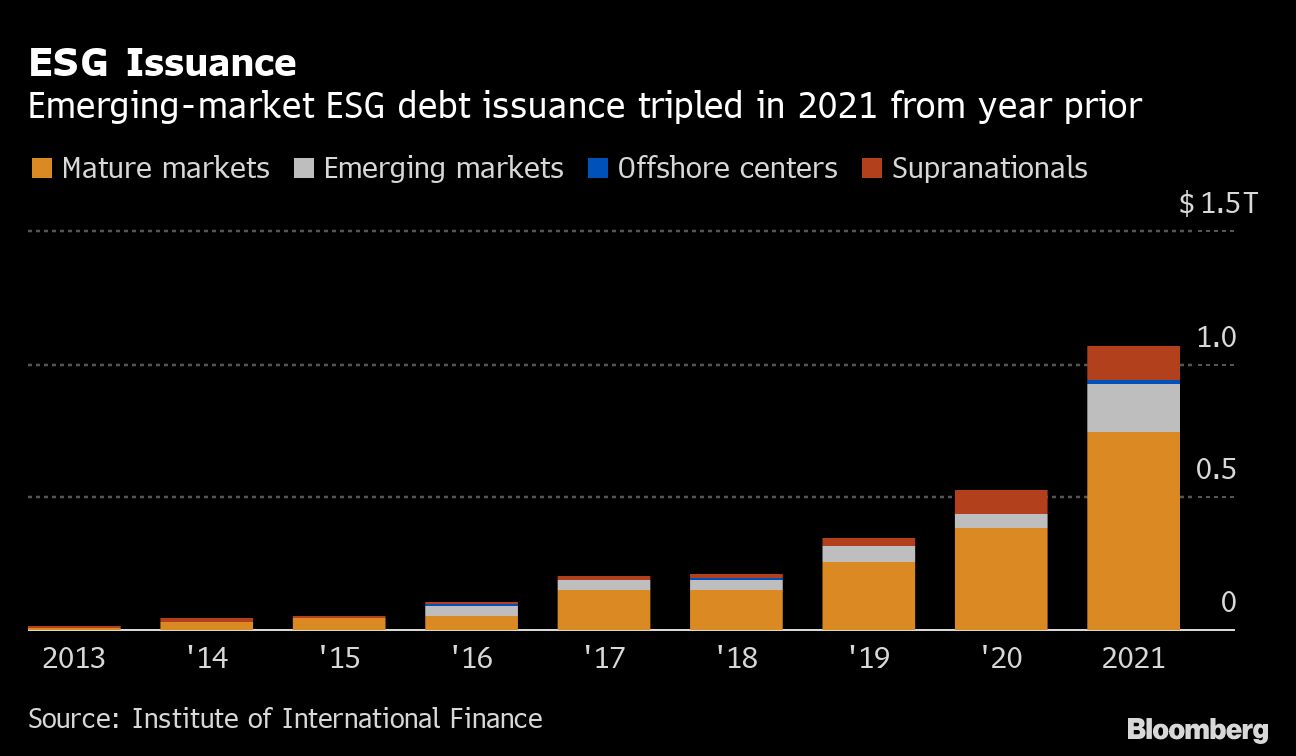

Emerging governments sold bonds geared toward environmental, social and governance issues at more than twice the pace of mature economies in 2021, when compared to the year prior, according to data from the Institute of International Finance. The growth rate of ESG bonds sales clocked in at 97% in mature markets last year, compared to 227% in emerging economies, the data show.

Total ESG issuance in developing and frontier markets reached $230 billion in 2021, up from just $75 billion a year earlier, according to the IIF. Socially responsible capital-raising of all stripes around the world is expected to reach $1.8 trillion in 2022, according to the industry group, which represents financial firms.

Such a boom in financing is not without its risks. Investors face the prospect of “greenwashing,” or the use of misleading labels to create an undeserved image of environmental and ethical responsibility — a concern particularly acute in developing nations where disclosure requirements are often lower than in more developed markets, making it harder to hold issuers accountable.

For borrowers though, it offers a rare bright spot after January saw the worst month for a gauge of emerging dollar bonds since the March 2020 meltdown — while the competition for global capital is set to intensify as the Federal Reserve seeks to hike rates in earnest.

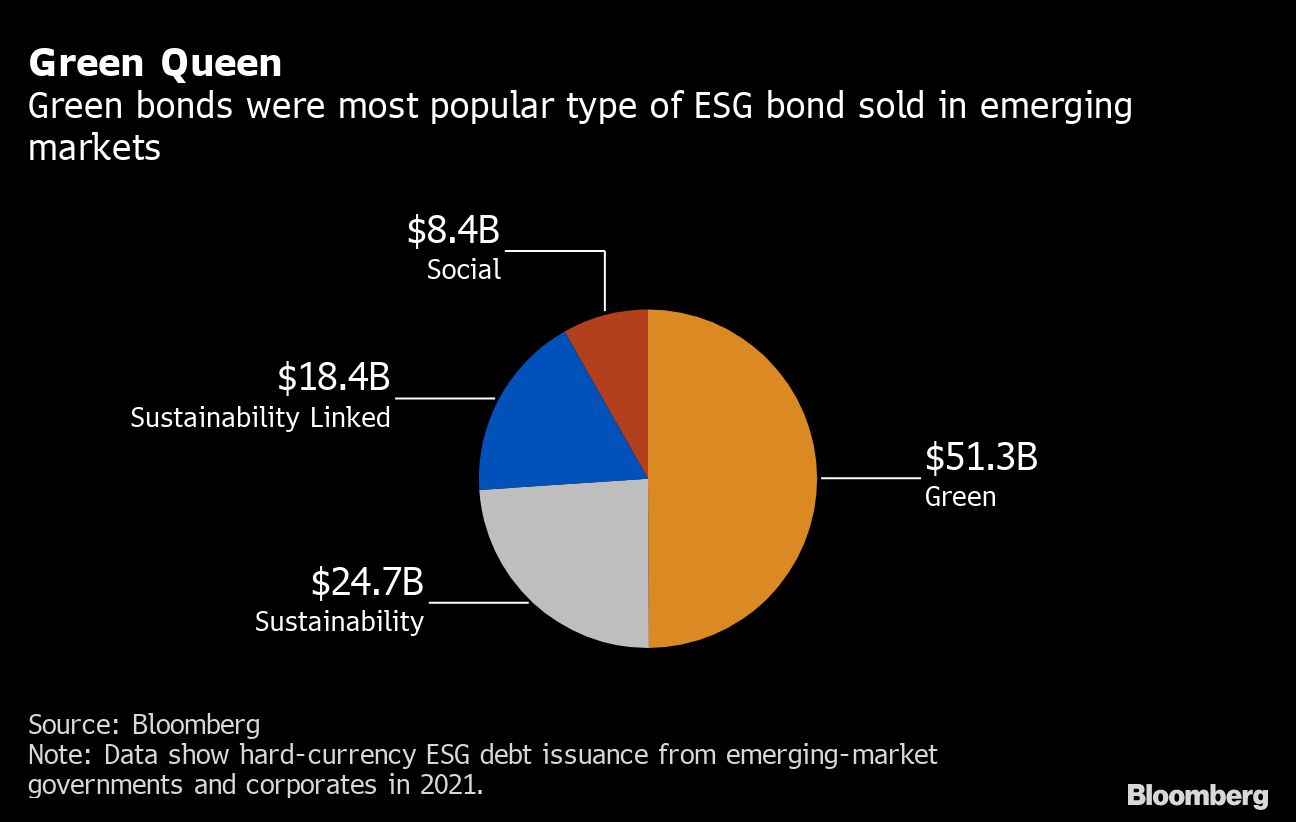

“We would expect continued strong issuance from both EM sovereign and corporate investors this year as the asset class attracts more interest and inflows,” said Jens Nystedt, a senior money manager at Emso Asset Management. “We are seeing an increased preference for sustainability-linked bonds, with verifiable targets, and away from the initial green and social bonds.”

The IIF’s director of sustainability research, Emre Tiftik, and economist Khadija Mahmood expect emerging-market sovereigns to sell about $40 billion in ESG eurobonds this year — or a quarter of such projected issuance.

Mexico’s ESG Bond Has Skeptics Questioning Do-Good Bona Fides

That’s not to say ESG investing is straightforward. While about 92% of the sovereign bonds in JPMorgan Chase & Co.’s benchmark emerging-market bond indexes have some sort of climate target in place, only about 22% report each year on their progress, according to Goldman Sachs.

As issuance increases from developing nations with less robust controls, skeptics see a growing potential for the vague ESG goals to be used to raise money cheaply. Under some issuance frameworks, there’s no actual guarantee cash raised in such debt deals will be used with environmental, social and governance considerations in mind.

All the same sovereign debt investing based on ESG metrics was the ticket to outperformance last year, with nations boasting high scores besting lower-ranking peers, according to Goldman Sachs strategists led by Sara Grut. It’s a trend that mirrors the outperformance of investment-grade credits versus high-yielding issuers, they pointed out.

For now, demand for ESG debt of all stripes remains intense thanks to profound regulatory and industry shifts. Sustainability-linked deals, which impose an interest-rate penalty on borrowers that fail to hit specific ESG targets, are also taking off, according to the IIF.

Mexico Champions Cutting-Edge Green Bonds in Emerging Markets

While the growth rate of ESG debt sales in emerging markets is pumped up due to a lower starting point, it’s a sign that the world is getting in on the sustainable trend. The new deal boom was led China, followed by Latin American nations such as Chile, Mexico and Brazil. India, Indonesia and Malaysia also contributed to the total.

“I think we’ll see a lot of more ESG issuance by high-yield issuers,” said Nystedt. “In particular, I would expect the Caribbean and Sub-Saharan African nations to use ESG-based bond issues to access a new investor base.”(Updates to include context throughout)

© 2022 Bloomberg L.P.