(Bloomberg) —

Green bonds. Blue bonds. Brown bonds. Environmentally-conscious investors may soon be able to buy a different color of asset every day of the week.

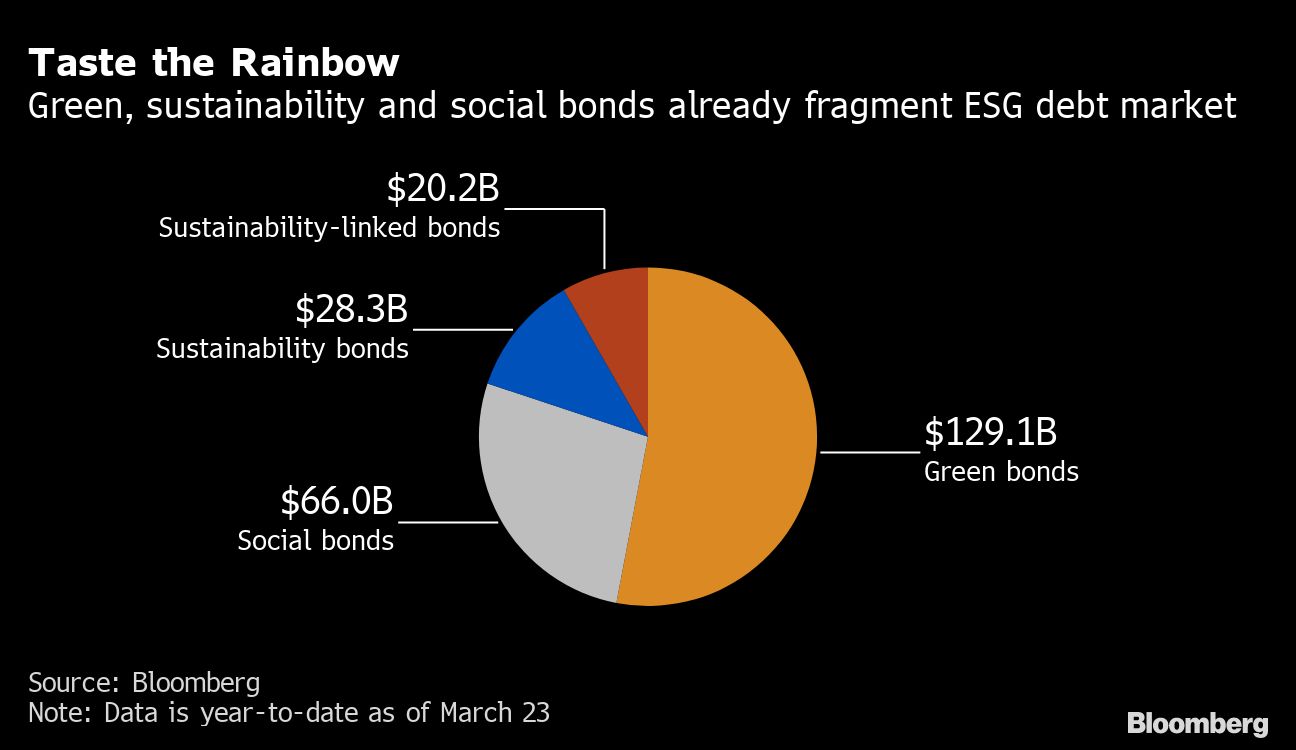

Record demand for sustainable finance is spurring this rainbow of debt types by governments and companies, to fund increasingly specific ways of mitigating climate change. While green bonds — which pledge their proceeds to finance wind farms or solar parks — are the dominant species, some of these labels have so far remained relatively niche.

That’s set to change as a market now worth over $2 trillion develops rapidly, and as financial engineers create new ways to brand such debt. The greater choice is a boon for the growing cohort of specialist funds with ethical mandates, yet also creates more due diligence in an asset class already lacking clarity thanks to a lack of uniform standards.Play Video

“It is confusing,” said Taimur Hyat, chief operating officer for PGIM, adding more universal rules and less fragmentation would be “extremely helpful” for PGIM to use its $1.5 trillion in assets to support the transition to a greener planet. “Clear guidelines will also avoid the risk for the perception for any greenwashing in the industry.”

It’s only five years since the world’s first green sovereign debt was issued by coal-reliant Poland, to help transition to a lower-carbon economy. Now the emerging spin-offs include blue bonds to fund marine projects, brown or transition bonds for industries too dirty to do green, nature bonds for biodiversity and carbon neutral to achieve net-zero emissions. Then there’s also social bonds to help society and sustainability-linked bonds to set organization-wide targets.

Chinese banks issued their first blue and carbon-neutral bonds in recent months. Junk-rated companies in Latin America are joining a European boom in SLBs given signs they can get lower borrowing costs, as well as boost their image. Pakistan is seeking debt relief by offering nature-performance bonds to rewild land this year, while the World Bank may debut wildlife conservation bonds to protect rhinos in Africa.

The European Union has already broken market demand records with its social bonds. Government stimulus to recover from the pandemic, together with a raft of net-zero ambitions, could “turbo-charge this trend and contribute to a sharp rise in sustainability-linked loans and thematic bonds in 2021 and 2022,” said Gabriel Wilson-Otto, global head of sustainability research at BNP Paribas Asset Management.

Just this week, Pilgrim’s Pride Corp., one of the top U.S. chicken producers, is selling $1 billion in bonds tied to environmental targets, the largest ever for the genre in the U.S. high-yield market as issuers come under pressure to be better corporate citizens. Chinese borrowers sold the country’s first carbon-neutral bonds last month as the state moves to meet President Xi Jinping’s ambitious climate-change targets.

Competing Rules

The increasing fragmentation is at odds with calls by regulators for comprehensive rules to shed light on the credentials of borrowers and their offerings. The world’s largest industry body for sustainable finance said Thursday the industry needs global standards and urged world leaders to act this year.

There are signs international policy makers are rising to the challenge. Joe Biden’s government is planning a U.S. green finance framework that should start to take shape by June, according to people familar with the matter. The U.S. and Europe could have an identical set of rules that determine what counts as green investment, French Finance Minister Bruno Le Maire said this month.

And China is also working with its European counterparts to announce a common green taxonomy this year, to define and classify green projects. That issue will be discussed at October’s Group of 20 meetings in Rome.

“It is acknowledged that the plethora of thematic labels in the market leaves room for confusion,” said Esohe Denise Odaro, chair of green, social and sustainability-linked bond principles at the International Capital Markets Association, which is the most widely followed so far. “Ultimately, it is the decision of an issuer how to brand their bond. Investors are more concerned with the underlying integrity of the bonds.”

Even in Europe, where sustainable bonds make up more than 20% of this year’s sales, there are no set definitions on what constitutes a green project. Individual countries have created their own as they push ahead with issuance before the EU’s rules come out. While these are expected to be rigorous, there are concerns member states won’t have to adhere to them.

The Asia-Pacific region is even more prone to fragmentation. Singapore’s monetary authority is consulting on a potential green taxonomy for Southeast Asia, even though neighbors Malaysia and Indonesia already have their own plans. China, too, has a catalogue of acceptable projects that stress the need to tackle the nation’s particular ecological and resource pressures.

Spoiled for Choice

The proliferation is at least providing environmental, social and governance investors with a broader array of assets than ever before.

“We are delighted to increasingly be ‘spoiled for choice’ in the fixed income space, as for many years this asset class lagged in its attention to socially-responsible investing,” said Ron Bates, managing director and portfolio manager at 1919 Investment Counsel. Analyzing the different types isn’t that different from investors traditionally reviewing the tenor, ratings, and liquidity of every new deal, he said.

But to gain broader acceptance to tap global capital, the market may ultimately need to become more streamlined. Transition bonds were touted as having huge potential to help oil companies move into renewables, yet there are still few such deals so far. Some firms are sticking to green bonds — despite the scrutiny that entails.

And within green bonds, there’s also a myriad of shades — light to dark green — as a new breed of ratings companies try to give investors greater clarity on just how kosher the offerings are.

“If you want to tap into the mainstream capital markets, you need to go where the mainstream investors are,” said Christopher Kaminker, who leads the sustainable investment team at Lombard Odier Investment Managers, referring to the established green bond market. “We know it’s proven that it’s mainstream and scalable.”(Updates with Chinese carbon-neutral bond deal in eighth paragraph.)

–With assistance from Todd Gillespie and Tom Freke.

© 2021 Bloomberg L.P.